Table of Content

Real estate attorneys often charge a flat fee per transaction ranging from $800 to $1,500. The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters. This option can be the least expensive in the long run if you can afford to part with the cash now and plan to keep your loan for a long time. That's a significant range and cost to factor into a house transaction -- particularly with home prices being at record levels. Many or all of the products here are from our partners that pay us a commission.

Some are related to your lender and the type of mortgage you’re getting, and some have to do with the real estate professionals who are helping you get your deal done. Apply for an FHA loan.Americans with lower incomes can apply for an FHA loan, a government-backed mortgage. Buyers can get a bit of help from interested third parties including real estate agents, sellers, and mortgage brokers, who can pay up to 6% of the new loan amount.

Which? Money podcast: Can a new PM solve the cost of living crisis?

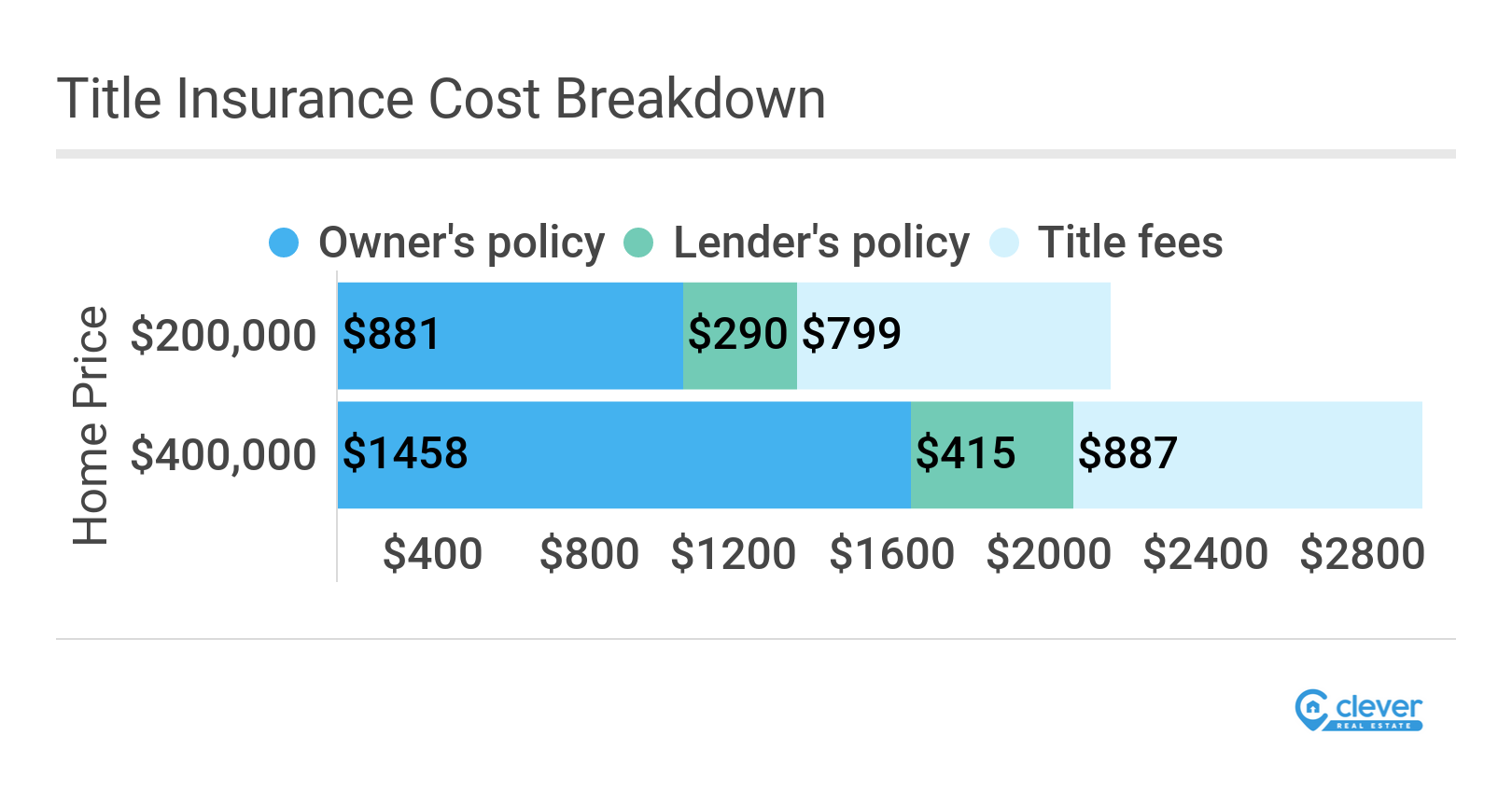

Realtor commissions, which the seller typically pays and are split between the listing and buyer agents, can add up to 5.5–6%. Some sellers also cover the buyers’ closing costs, which can total 2–3%. Instead of paying cash upfront or paying a higher interest rate, you can finance a larger sum by tacking your closing costs onto the loan principal. Your monthly payment will be slightly higher, and you'll pay interest on the additional amount you're financing. If you're close to the upper limit of what a lender will give you, this might not be possible. Transfer taxes are the taxes imposed by your state or local government to transfer the title from the seller to the buyer.

This means that if your closing costs on the same loan were to equal $2,500, the seller can only offer up to $2,500. Closing costs don’t include your down payment, but can be negotiated. Just be aware that your negotiating power can depend heavily on the type of market you find yourself in. Many first-time home buyers underestimate just how much they’ll need to pay in closing costs. Some may not know there are ways to lower how much you’ll pay. Typically the buyer pays closing costs, though sometimes negotiations between the buyer and the seller can lead to the seller paying some of the closing costs.

States Where Closing Costs Decreased

You might need multiple foundation-related inspections in cold-weather areas like Washington, Illinois. © 2022 NextAdvisor, LLC A Red Ventures Company All Rights Reserved. Use of this site constitutes acceptance of our Terms of Use, Privacy Policy and California Do Not Sell My Personal Information.

The exact closing costs vary from state to state — even among counties and cities. Before closing, talk to your real estate agent or real estate attorney about which closing costs are required. This means that the buyer would continue the same title insurance as the seller.

Tips on Lowering Closing Costs

Most buyers hire real estate attorneys when the real estate transaction is unusual or complex. Some instances of these are joint ownership of the house, private loans from family or friends, the presence of easements on the property, etc. However, you can hire an attorney even if your transaction is not unusual. Usually, lenders hire an appraiser to determine the fair market value of the property the buyer wants to purchase. This helps them determine the loan amount and the loan-to-value ratio.

Also known as a government transfer tax or title fee, these are the taxes you’ll pay when the title for the home passes from you to your buyer at the time of closing. “If you’re paying cash for a property, there are still a few closing costs, but they are significantly less,” saysCara Ameer, a Realtor® in Ponte Vedra, FL. If you live in a buyer’s market, your seller might be willing to help you cover your closing costs. You must generally pay a VA funding fee at closing if you buy a home using a VA loan. Your VA funding fee goes toward administrative costs for the VA loan program. The amount of the funding fee is based on down payment and if it’s a purchase or refinance as well as whether it’s your first time or a subsequent use of your VA benefits.

With a conventional loan, you also have the ability to pay for part or all of a PMI policy upfront at closing in order to have lower or no monthly fees for mortgage insurance. Homeowners insurance is a type of protection that compensates you if your home gets damaged. Most mortgage lenders require you to have at least a certain amount of homeowners insurance as a condition of your loan to cover damage.

Sellers may be willing to offer concessions or credits toward the closing costs, which are then worked into the overall purchase price. Here are some strategies for buyers to keep their costs low, which can also help sellers when negotiating a concession. This guide will walk you through the typical closing costs for sellers, identifying what they are and how you may be able to reduce some of those fees. These are the states with no real estate transfer taxes, which should result in lower closing costs. The average closing costs in the United States, if you include taxes, are $6,905, up from $5,749 in 2020.

During the low season, the price for the stay would fall to $677 for the same room. During the low season and choosing cheaper meals and fewer excursions, you could pay as little as $567 for the same trip. Introductory care agencies act as a matching service and will introduce you to self-employed, private carers.

Your lender might ask you to pay any interest that accrues on your loan between closing and the date of your first mortgage payment upfront. The amount of interest you’ll accrue depends on your loan amount and interest rate as well as your closing date. Depending on the situation, this may be covered by the buyer, seller or lender.

Closing costs are a set of expenses that the seller and the buyer must pay to finalize the real estate transaction and transfer the ownership of the house. The buyer can negotiate certain closing costs with the seller and the lender. What’s valuable about many of these programs is that homebuyers can use them in place of their savings, which is a major financial boon when taking on homeownership. Most experts recommend keeping around six months of expenses in reserves so that you avoid paying for unexpected emergencies with credit cards or personal loans. Sellers may also agree to seller concessions, which help cover the closing costs for the buyer. Lenders will often permit you to pay "points," sometimes called "discount points," at closing.

No comments:

Post a Comment